In the “Oliver Velez Trading Masterclass,” you will receive expert guidance from a trader with over four decades of experience. With a focus on sharing 10 crucial steps for becoming a profitable trader, Oliver Velez offers valuable knowledge that most traders are unaware of, leading to successful careers in trading. Whether you are seeking growth in your trading profession, aiming for profitability, or striving for financial freedom, this Masterclass is tailored to meet your needs. For personalized support, you can easily contact Oliver Velez’s team through WhatsApp or email, or follow him on various social media platforms for more trading insights and updates.

Oliver Velez, known as the “Messiah of trading,” brings his 31 years of experience on Wall Street to help traders elevate their skills through master classes and deep dives into trading techniques. The program provides training, education, technology, and capital for traders, with a Fund Traders program that started in 2007 and now has 9,000 traders worldwide. By attending this Masterclass and learning the 10 essential steps shared by Oliver Velez, you will set a strong foundation for your trading journey, ensuring that you are on the right path towards profitability and success in the trading industry.

This image is property of IFundTraders.

Step 1: Pick the right Time Frame to Trade

When engaging in trading, it is crucial to select the appropriate time frame that aligns with your trading strategy. In Oliver Velez’s Trading Masterclass, he suggests focusing on shorter time frames ranging from 2 to 5 minutes. This shorter time frame allows for quick decision-making and capitalizing on short-term market movements. By choosing the right time frame, you can effectively execute your trading plan and increase the likelihood of profitable trades.

Step 2: Use the right moving averages

Moving averages are commonly used technical indicators that help traders identify trends in the market. In the Masterclass, Oliver Velez recommends using the 20-period and 200-period moving averages. The 20-period moving average provides a more immediate trend indication, while the 200-period moving average offers a broader perspective on market direction. By incorporating these moving averages into your analysis, you can make more informed trading decisions based on trend signals.

Step 3: Know Your State

Understanding the current state of the market is essential for successful trading. Oliver Velez outlines three primary states that markets can exhibit – Narrow, Trending, and Wide. The Narrow state, characterized by tight price ranges, is considered optimal for trading as it often precedes significant price movements. By recognizing these different market states, traders can adjust their strategies accordingly and capitalize on potential opportunities.

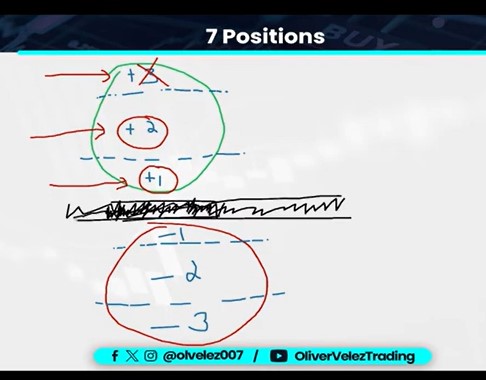

Step 4: Know Your Position

In trading, it is essential to determine your position relative to the market. Oliver Velez introduces seven position levels, ranging from +3 to -3, with the 7th position situated between the moving averages. Position 1 is highlighted as the most favorable for trading, with +1 indicating a Long position and -1 indicating a Short position. Understanding your position in the market can help you strategically enter and exit trades for optimal results.

This image is property of OliverVelezTrading youtube.com.

Step 5: Learn the 3 Reliable Events

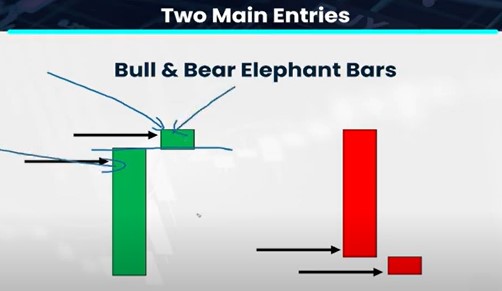

Identifying reliable trading events is key to making informed trading decisions. Oliver Velez emphasizes three primary events that traders should focus on – Bull & Bear Elephant Bars, Bullish Tail Bars, and Bull & Bear Color Changes. These events provide signals of potential market reversals or continuations, allowing traders to anticipate price movements and adjust their positions accordingly. By learning to recognize these events, traders can enhance their trading accuracy and profitability.

Step 6: Entry Method

When entering trades, traders can choose between anticipation or confirmation-based entry methods. Anticipation involves entering a trade before a specific event occurs, while confirmation entails waiting for validation of a trading signal. Depending on your trading style and risk tolerance, selecting the right entry method can help you enter trades at opportune moments and maximize profit potential.

This image is property of images.pexels.com.

Step 7: Initial Stop Event or Maximum

Managing risk is a critical aspect of trading success. Oliver Velez advises setting stops 1 penny above events for short positions and 1 penny below events for long positions. By establishing clear stop-loss levels, traders can limit potential losses and preserve capital when trades move against them. Implementing effective risk management strategies can safeguard trading accounts and enhance long-term profitability.

Step 8: Add Method

Adding to winning trades can amplify profits and capitalize on favorable market conditions. Oliver Velez suggests adding onto winning positions to maximize gains and take advantage of trend continuations. By strategically scaling into trades based on market momentum, traders can increase their overall profitability and optimize trade outcomes.

Step 9: Trade w/ the 20 Moving Average

Utilizing the 20-period moving average as a reference point for trades can help traders gauge market direction and potential entry points. Oliver Velez recommends taking trades close to the 20 moving average to align with the prevailing trend and increase the probability of successful trades. By incorporating the 20 moving average into your trading strategy, you can enhance trade accuracy and optimize trade entries.

Step 10: Taking Profit

Knowing when to take profits is essential for successful trading outcomes. Oliver Velez introduces the Profit Taking Technique, which involves using bar count and distance to determine optimal exit points. Additionally, the 3 Push Rule suggests taking profit on the third bar after buying to capitalize on price movements. By implementing effective profit-taking strategies, traders can secure profits and achieve consistent trading success.

In conclusion, mastering these ten crucial steps outlined by Oliver Velez Trading Masterclass can significantly enhance your trading skills and profitability. By following these proven strategies and techniques, you can increase your trading success rate, minimize risks, and maximize your potential for long-term profitability in the financial markets.